How to Manage and Forecast NRR

Every CCO or Head of CS has the pressure of managing NRR and explaining to the Executive Leadership and Board what strategy and tactics are planned to drive results to the targets. When NRR is not hitting the target, they want to know why and what is your course correction plan.

I believe it is critical that all CS leaders learn and understand what the SaaS acronyms are, their definitions and how to use them to help them to lead and manage customer performance to targets.

Key Terms and Definitions

I’d like to start with a list of acronyms and definitions to help understand these terms and how we will use them in planning and forecasting NRR:

Acronym | Definition | Calculation |

|---|---|---|

MRR | Monthly Recurring Revenue | |

QRR | Quarterly Recurring Revenue | |

ARR | Annual Recurring Revenue | |

NRR | Net Revenue Retention | (Starting MRR/QRR/ARR - Downgrade in MRR/QRR/ARR -Churn in MRR/QRR/ARR + Expansion in MRR/QRR/ARR) ____________________ (Starting MRR/QRR/ARR) |

Logo Churn | % Customers Churned out of the base | Starting # Customers - # Customers at End of Period ___________________ Starting # Customers |

Revenue Churn | Total Customer Revenue Churned | Starting MRR/QRR/ARR - Ending MRR/QRR/ARR ____________________ Starting MRR/QRR/ARR |

Customer Lifetime Value | Total Revenue earned from Customer over the lifetime of the partnership | CLV = CV X CL CV = Customer Value |

Company Targets Defined by CFO

Using the terms above, we can begin with the basics that should be defined in order for CS leadership to put their monthly and quarterly forecast plan together.

The CFO and the Executive leadership should have an approved budget plan for the year with the targets established for Net New Revenue, Expansion Revenue and Churn rates. With the Beginning ARR (ARR that the Fiscal or Calendar year is starting with), you add the planned Net New Revenue, Expansion and Churn to the Beginning ARR and you will have the planned target ARR revenue for the end the year.

The CFO usually will provide the leadership team with a quarterly plan that breaks these targets down by quarter. These are the targets the Executive leadership team review each week to track weekly, monthly and quarterly results.

The CCO or Head of CS will have a breakdown of the customer renewals by quarter based on the customer subscription renewal dates. For example, Q1 will have a report of all the customers due to renew between Jan 1st and Mar 31st (if using a calendar year). The report will have each customer’s name and subscription value that are up for renewal based on date of renewal, that reflects the current signed subscription agreement. Once you add up all of these customer subscription values for the quarter, you will have a total QRR. The total of all four quarters should equal the starting ARR for the year provided by the CFO. This is your starting ARR for the year and the amount of contracted subscription revenue that you want to preserve and grow for the Fiscal or Calendar year as defined by the CFO.

However, we all know that Churn happens even with the best of products and services. The CFO will have a planned Churn goal that should also be broken down by quarter. For Example, if you have a QRR goal for Q1 of $1m and a planned Churn rate of 5%, then the CFO has planned for a QRR target of $950k.

This is not the ultimate plan for the quarter though. The next goal is the expansion or growth revenue from the customer base that the CFO has planned. This makes up for planned Churn as well as adds additional revenue growth towards the annual goal. Using the same example above, the CFO may have a 40% growth rate in the plan for expansion for Q1. This means that there is a $400k expansion goal. This expansion goal can be on the subscriptions that are coming up for renewal and/or other customers with future renewals. The planned Q1 outcome goal would be $1,350k ($950k Retention + $400k Expansion).

Manage and Forecast NRR to drive to results

These are the main targets the CFO will set in the plan. As the Head of CS or CCO, you will need to manage and track these at a more detailed level for the quarter in order to manage to the Revenue Targets and Forecast NRR.

There are two types of Churn that are tracked:

Downsell (Reduction in Users, Price and/or drop of a product)

Churn (Entire Logo Churn, cancellation of the contract)

and two types of Expansion that are tracked:

Price Increase

Upsell Expansion (Additional Users/Products/ New Business Units added)

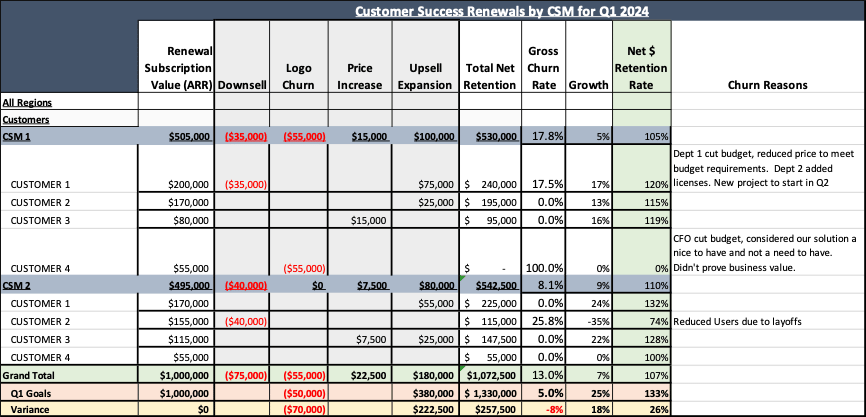

With the above understanding of the elements that are tracked and managed weekly, monthly and quarterly, the following is a simple example of what an NRR Forecast plan would look like for one quarter:

Quarterly NRR Forecast Report

Using the report above, I will walk you through each column.

First Column, Renewal Subscription Value = The subscription value up for renewal.

Second Column, Downsell = The reduction in subscription value due to a decrease in price, users or products from the original contract.

Third Column, Logo Churn = The total subscription value if the customer has provided a Non-Renewal notification and will not be renewing the contract.

Fourth Column, Price Increase = Reflects the subscription value increase due to a product or service price increase.

Fifth Column, Upsell Expansion = The subscription value increase due to adding users, new business unit or products to the contract.

Sixth Column, Total Net Retention = Total of all of the above columns. Original Contract ARR value + Downsell+Logo Churn+Price Increase + Upsell Expansion.

Seventh Column, Gross Churn Rate = Reflects the subscription value lost in a given period. ((Downsell + Logo Churn)/Renewal Contract ARR).

Eighth Column, Growth Rate = The percent increase in subscription contract value for the period.

Ninth Column, Net Retention Rate = Total Net Retention/Renewal Subscription Value.

Based on your NRR rate, you will need to understand what improvements you need to drive in growth rate to overcome each percent reduction in Churn. For example, If your plan has an NRR target rate of 135 percent, with a planned Churn rate of 5 percent and a growth rate of 40 percent, then based on what you forecast the Churn rate to be at the end of the quarter, you will need to manage the growth rate to accordingly to still achieve the 135 percent NRR goal.

Reviewing the example forecast report above; the Churn is over the goal by 8 percent and the Growth rate is short to the goal by 20 percent. In order to get the results back on track, either the team will need to save some portion of the revenue churn and downturn or go after a 48% growth rate on the customer base by analyzing the opportunities to increase price or expand.

The beauty of this report is that you can analyze what needs to be done from week to week through out the quarter to drive results towards the quarterly goals. To manage the forecast and drive the results to the goals, there are a few tactics that can be executed to improve the Churn rate. One tactic would be to save the customer logo losses with an executive level meeting from both parties to ask what it would take to retain their business. Another tactic may be to improve revenue expansion to make up for downsell lost revenue. This would require considering a price increase if they reduced the number of users which may negate their previous discounts and/or asking for introductions to new business units with incentives if the new business can be added into the contract by the renewal date.

How to Create a Forecast Report

The data required to create this type of report will usually come from your CRM system. Most CRM systems can track each of these types of subscription contract changes in order to understand what the main drivers are that can impact the NRR forecast. In my previous companies, we used Salesforce and CPQ to track the types of changes in subscription value and the CS team owned the Renewal and Expansion targets. This meant the CSMs updated the forecast weekly in Salesforce.

The report works best if you group it by Region and CSM as a drill down, it allows for you to review how each region is performing at the top line. Based on the weekly changes you review in the report, you can identify the regions and CSMs who may be forecasting below the targets for the quarter. This allows the CS leadership team to provide guidance and support to help address the customer situation and issues.

The CSMs would also use the Customer 360 degree dashboard to analyze the customer situations for those customers that are at risk to not achieve their target subscription value. This is the dashboard that would show the details of the Customer’s product usage, roadmap goals, implementation and adoption progress and performance, outcomes achieved, entrenchment factors (aka sticky factors), adoption, values realized, issues logged, enhancement requests, NPS, CSAT, etc. This dashboard can also have a Customer Performance Score (aka Health score) that can be used to identify customer’s who may be dropping off in their operationalization of the product, which may be the reason for the decrease in their value realization. I will discuss this in detail in a future Newsletter article.

The CS and Sales Teams should provide their updates in the CRM system weekly to ensure this report is accurate for each customer with a renewal for the quarter for their region or business unit.

Here are companies with NRR of 120 or higher

Snowflake – 169%

Twilio – 155%

Datadog – 146%

Slack – 143%

Zoom – 140%

Elastic – 130%

Crowdstrike – 128%

According to the data from SaaSBrief

100% or below — Investigate and identify the cause of the issue.

110% you’re at the median compared to the industry benchmark 120% and above, your business is on the right track with healthy revenue growth from existing customers.

“NRR is a customer-centric metric, and the CS team owns it”

When you track NRR by Target Market, by Region, by CSM, by Customer, you will have a deeper knowledge of your customers and what the ideal ICP (Ideal Customer Profile) is as well as how to replicate the approach, methodology and processes required to create value for 10 out of 10 customers.

As we discussed in previous Newsletters, the Customer Roadmap plan is the key to driving value for your customers. If you want customers to stay with you and expand, you will need to give them a plan on how to get there. When you master your Customer Roadmap Plan, you will master forecasting NRR within 10% accuracy.